Here are some important strategies to streamline your payment process.

Don’t wait.

As soon as a deal is signed, you should initiate your payment process. This allows you to clarify payment expectations from the very beginning and to answer any questions that the customer might have. If you delay, you run the risk of creating confusion about how the process works or losing the customer’s prompt attention to their payment obligations.

A good strategy is to create a payment plan with the customer once they make their down payment and you’ve reached an agreement regarding financial terms. You’d then be explicit about the length of the payment plan, how much is due each month, payment due dates, and payment options.

Don’t use paper.

This is the 21st Century. It’s time to move away from hard copies of purchase agreements and purchase orders that have to be copied, filed, and physically secured. Plus, paper is vulnerable to getting lost, misfiled, or destroyed.

An electronic system is much easier for you and the customer. An electronic signature can be provided instantly and remotely — even while your prospect is still on the boat! And these important documents can be stored securely online with much easier access for you and the customer.

Use text or email.

Send payment requests and work orders via email or text. When bills are sent in the mail, they are much more likely to get stacked in a pile with other bills and ads, which makes them much easier to ignore.

You’ll be much more likely to get the customer’s attention and to initiate a prompt response if payment requests are sent via email or text message. Text is the best communication method because it has a 95% open rate. Be sure to suggest text messaging during your sales process, so your customers have the dealership as a contact and are expecting your messages.

Avoid credit card storage.

It’s convenient for your customers when they can store their credit card information online, but doing so on your own website puts their financial data at risk of being stolen. Hackers make it their business to breakthrough online security systems and firewalls in order to steal people’s personal information.

Storing credit card information on your website not only compromises your customers’ personal information and opens them up to problems with theft and fraud, but it jeopardizes their confidence in your dealership. It’s best to avoid this type of credit card storage.

Use a payment partner.

Fortunately, you can still provide customers with the convenience of online payments with saved credit card information. Using a modern payment partner like Stripe means that your customers can still make online payments quickly and easily, but their information will be secure.

With a payment partner, your customer will plug in payment information online through a payment portal provided by the partner company. The payment information is then encrypted on the customer’s device before it is sent to the financial institution for processing. The additional layers of security provide protection and peace of mind to both you and your customers. (Our platform uses Stripe for payment processing, so your data is always protected.)

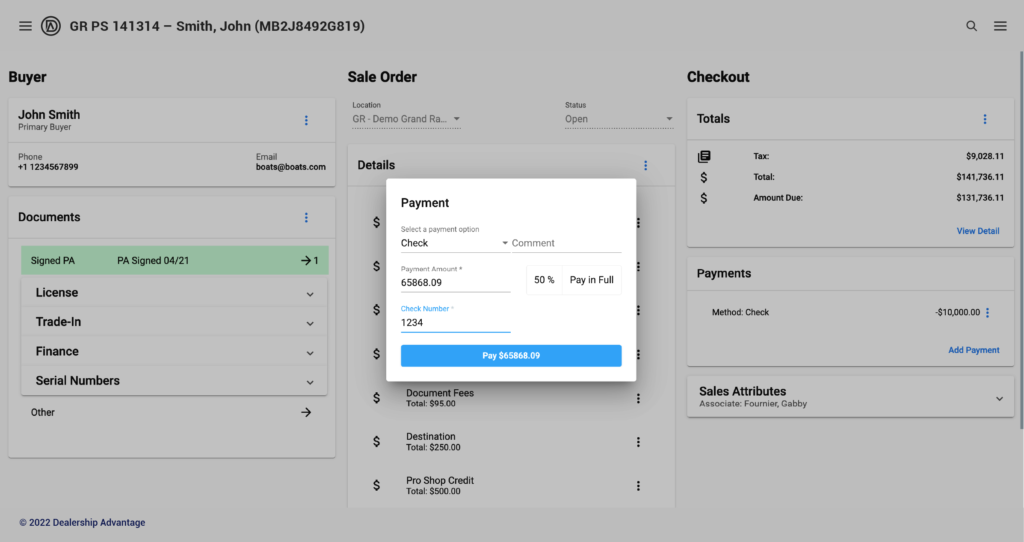

Use a DMS.

The best way to streamline your payment process so that it is easy and accurate is with a Dealer Management System or DMS. Dealership Advantage offers a DMS that will automate your payment process, enhance the customer’s experience, and provide you with real-time financial data. Our DMS integrates seamlessly with Stripe, which makes it easy to implement. Most importantly, a DMS allows your dealership to operate more efficiently and to make important improvements to your daily operations.